Stock Options in Startups - A scam or something worth a shot?

After some years working in startups I thought it was about time to write a blog post with some thoughts and experiences related to the stock options you sometimes get in this type of companies.

When I was in Barcelona I often thought about how great it would be if more companies offered stock options. But this thought has changed lately and I would like to explain why.

Most of this is just plain common sense and some of you may say “hey, this is very clear in the contract, you should know what you are signing” but the reality is that most of us don´t know much about these things and only experience teaches us.

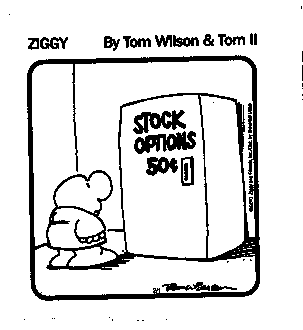

For those of you loving the TL;DR statements: If someone offers you stock options, treat them as a lottery ticket for a raffle that will rarely happen and even if it happens you almost always need to be there when it happens and it may not be as profitable as it seems. NEVER treat them as a bonus or extra salary.

If you are a founder or work in HR and tell people you offer stock options to compensate a lower salary you are just trying to scam them. Yes, pure scam. Period.

And if you are a non technical founder thinking “OH, another arrogant tech guy not valuing we are giving away some % of our great idea” please think about how much it costs you to hire good people and how much you are really giving away by offering us less than a 1% of technically nothing.

The reality is that we are the ones taking risks joining your dubious startup just because we like you or your idea. Or both! And if things work out really well, it is a win-win situation, at best you will lose less than 1% of your potential gains.

Disclaimers before we start

Most of these things are standard contracts. I don´t feel myself being more scammed than the next developer. This is not against you, former employers. This blog post intends to be for tech people who will hopefully be able to understand and judge better what you are really offering when stock options are part of the offer.

My legal and financial knowledge is limited. If something I say here is not accurate or just complete bollocks, please feel free to comment or email me and I will amend the blog post so that it reflects the reality as accurately as possible

There are different types of stock options and different states of the company.

- Most of what I say here is related to the ISO (Incentive Stock Options)

- Some companies (specially in the US) are apparently starting to offer conversions to NSO (Non-qualified Stock Options) which can be executed way further down the line

- Some companies are offering now another type of stock called RSU (Restricted Stock Units)

- In some countries you will still usually get what is called Phantom Stock Options which despite having a discouraging name, they can sometimes be actually better and fairer than ISOs

- It is a completely different story when you join a big startup which is already public or you can exercise your stock versus when you join an early stage startup

Vesting

Most of you possibly know about this one but I did not before I had my first stock options contract so I guess it is worth reminding. You will almost always have a vesting period associated to your stock options which is often 4 years, getting 25% after 1 year and then either 12.5% every 6 extra months or the proportional bit every month.

This means that if you leave the company before these 4 years, or the stock options execution event happens before 4 years, you are only qualified for the proportional bit.

However, this does not really matter unless the company becomes public or you have a way to actually exercise them as it is explained in the next sections. And realistically, in early stage startups you will rarely be able to do it unless you stay for the whole period.

90 days to execute

This infuriates me. Most of the times, you will only have 90 days to execute your stock options after you leave a company. Again, this is not a big deal if you can exercise them (or even exchange them for money if you can sell them) as you have plenty of time but it is really bad and absolutely unfair if you can´t.

Think about it, you have worked your ass for 4 years in that place but you decide to leave because you are tired of getting a lower salary or you just want to do something else. 4 months later someone buys the company. You end up with NOTHING. Not cool at all, right?

Some companies are starting to change this, specially in the US, but in most cases there will be no buyer in 90 days and you will have to choose between paying to exercise them (and most of the times you won´t be able to do so, check next bullet point) or just let them go.

Execution only in some events

This is an obvious one but I did not realise it until it happened to me. However, combining this with the previous bullet point is what makes me think that stock options in early stage startups are often useless and realistically close to a scam if they told you the stock was to compensate a lower salary.

Most importantly, if the founders did not have any intentions to sell the company or go IPO any soon, unless there are other execution events planned, they are totally useless.

Some contracts specify the events that can trigger stock options execution. These are relatively limited, as it is mostly either someone buying the company or going IPO. Or for instance, the company may get acquired by a bigger player and this may be an execution event after the new valuation happens.

Again, unless some of these events happens while you are in the company + 90 days your stock will be lost, as you will not be able to buy even if you wanted.

Also bear in mind that even if you satisfy all the conditions to execute your stock and you have vested 100% of it, this does not necessarily mean you will be able to actually execute it. It really depends on the deal your company got with the buyers, new VCs or any parties involved in the event.

And if we start thinking ill, and I often do so as I am a terrible person, there is a very scary scenario. A group of founders may have a deal closed under the table, make most of the team redundant alleging bad finances and 4 months later execute the deal. Everybody will have lost the stock options but the ones standing! Yay!

Types of stock options

Most of the times you will get ISOs, which you need to execute within 90 days after you stop working for that company as mentioned before.

Some companies are starting to offer now an automatic conversion from ISOs to NSOs which can be exercised up to 10 years after you stop working there. This is much fairer approach IMHO although I am not sure about the exact legal details as it has never happened to me yet. You can read a bit about this at this Quora thread

Some others are offering RSU. You can read a comparison with the usual stock here. They are similar to the ISO stock as there is an associated vesting period and conditions to be able to exercise. But unlock the stock options there is no purchase involved, so they can be a better deal if your startup valuation has gone crazy and so has the stocks execution price. After vesting, RSUs are transferrable if the employee accepts the grant. And they have a defined value: the closing market value of the stock price on the vesting date. In contrast, Options that can decline in value by the time of vesting.

And the Phantom Stock Options are a way to effectively give employees a bonus without compromising the actual stock but still have the bonus related to how the real stock performs and not say the company sales or other common bonus schemes. I think this is a more realistic approach in many situations, founders and potential VCs keep their stock and employees get a bonus when things go great for everybody.

There are other types of stock but it is rare that you get them in startups. If someone has experiences with different situations, please share!

Liquidation preference

Be very careful about this one. Quite often, there is a difference between preferred stock (investors and perhaps some founders) and common stock (everybody else). And in the event of a selling, preferred stock holders get a guaranteed amount of money from the sale.

Imagine a VC who buys 50% of a company for $50 million, at a $100 million post-money valuation and the preferred stock has a a 2X liquidation preference. If the company is later sold at $75 million, that VC will get the full $75 million back and the common stock will get NOTHING unless the company is sold for more than twice the money they put in the first place. $100 million in that case. Scary huh?

You can read more details about all this here

Taxes when you execute

You made it, you stayed for 4 years and 1 month, the company just got sold and you can execute your stock options. Hurrah! Let´s imagine you get $50k selling them. In most countries, this will be taxed apart from your regular income and you will have to pay something around 40%. In the UK, AFAIK, this is currently 10% as part of the government startup creation program but will possibly change in the future. Please share the % in other countries if you know about it!

Let´s imagine now a less favorable scenario. You have been for 3 years, the company is going really well but you get a very interesting offer somewhere else. You are leaving the company but you can execute your stock options nonetheless (check your execution events) and you decide to explore this option as you genuinely believe the company will sell eventually and you will be able to cash out. You may then face a very sad reality. If there is a new valuation and your stock is potentially worth double you will be taxed by this potential gain, even though you are technically not able to cash it!

You can read a bit more about this here but generally speaking it looks like early exercise is a way to protect yourself and buying stock without knowing what will happen can be financially VERY risky. I am not 100% sure if this works the same way in all countries so, again, please share your experiences.

Bear in mind that RSU or Phantom Stock have different tax implications and to make things more complex, this is different in every country. Be very careful here.

Should I join a startup offering stock options?

First of all, startups are fun are great places to work. You will surely get out of your comfort zone, meet excellent people and will rarely regret the experience. However, if you are in the startups world hoping for the next Facebook and be able to retire young… well… you may consider buying lottery tickets which have better chances!

If you are offered stock options, ask questions about them. This may give you an idea on how transparent the company is with employees and how proficient the financial department is. If they are able to drive you through a variety of scenarios explaining the outcome of the stock you are golden. But if you get vague answers or they say “it is fairly standard” you are possibly getting ISOs with 90 days to execute which are mostly useless. Or maybe they don´t even know what they are really offering, which should raise some red flags!